inheritance tax law changes 2021

This 300 deduction is one of the tax law changes in 2021 that provides a significant benefit to individual taxpayers. Generally there will be an estate tax exemption where estates under a certain set amount will not be subject to a tax.

The 10 Best Ways To Avoid Inheritance Tax Money To The Masses

The legislation would lower the federal estate tax exemption level from 117 million to 35 million per individual resulting in a larger number of estates owing estate tax.

. Which is 117 million for. In the current tax year 202223 no inheritance tax is due on the first 325000 of an estate with 40 normally being charged on any amount above that. Taxes are never popular but Inheritance Tax IHT is arguably subject to more criticism than any other.

Estate tax applies at the federal level but very few people actually have to pay it. Its only charged on the part of your estate thats above the threshold. In 2021 Iowa passed a bill to begin phasing out its state inheritance.

Los Angeles County Assessor Jeff Prang has. An investor who bought Best Buy BBY in. For exempt estates the value limit in relation to the gross value of the estate is increased from 1.

Lets break down who has to pay it how much and how to minimize it. For the vast majority of Americans the federal estate tax the death tax has been a non-issue. There are signs that the Federal exemption for estate taxes may be lowered in 2021.

Second the federal estate tax exemption amount is still dropping on January 1 2026 from 11 million to 5 million adjusted for inflation. 19 or other tax savings programs visit assessorlacountygov or call 213 974-3211. That is only four years away and.

Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania. The potential risk for. The good news on this front is that the reduction of the estate and gift tax exemption.

Changes Coming to Inheritance Tax in Iowa. Ad Inheritance and Estate Planning Guidance With Simple Pricing. However what is charged will be less if.

Often referred to colloquially as death tax it is a levy that is placed. The limit for chargeable trust property is increased from 150000 to 250000. The exemption was 117 million for 2021.

This is approximately a 12 increase in the top estate tax rate. In 2020 many wealthy taxpayers were planning to take advantage of current gift and inheritance tax laws anticipating the possibility that as early as 1. Gifts and generation skipping transfer tax exemption amounts are indexed for inflation increasing to 117 million in 2021 from 1158 million in 2020.

Biden proposes ending this basis step-up for gains in excess of 1 million for single taxpayers 25 million for couples and ensuring that gains are taxed if the property isnt. In 2022 Connecticut estate taxes will range from 116 to 12. From Fisher Investments 40 years managing money and helping thousands of families.

The tax rate on the estate of an individual who passes away this year with an estate valued over the 1158 million exemption is also a flat 40. Targeted at multimillionaires and billionaires this proposal imposes a new death tax on many families with long term investments. In 2022 there is an estate tax exemption of 1206 million meaning you dont pay estate tax unless your estate is worth more than 1206 million.

Only six states actually impose this tax. The standard Inheritance Tax rate is 40. Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021.

For more information on Prop. As of 2021 at the federal level the exemption is set at 117. On May 19th 2021 the Iowa Legislature similarly passed SF.

Democrats in the House and Senate are moving toward scaling back or potentially dropping President Joe Bidens proposal to significantly limit the tax exemption known as step. Almost 90 of taxpayers qualify for this deduction. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

Under the EU Succession Regulation the law of the place of residence on death is presumed to govern inheritance so if France is the deceaseds place of residence French law will apply to. An inheritance tax is paid by beneficiaries on inherited money or property. Reduce the current 117 million federal ESTATE tax exemption to 35 million.

Example Your estate is worth 500000 and your tax-free threshold is. 619 a law which will phase out inheritance taxes at a rate of 20 per year and. Inheritance tax to be affected by new law arriving in 2021 grandparents may be hit INHERITANCE tax pensions and other financial considerations may be impacted by.

Use It or Lose It EstateGift Tax Exemption Cut in Half Effective January 1 2022. Additionally the Biden Administration wants to increase the top estate tax rate from 40 to 45. Meaning estates under 1158 millionpossibly a LOT.

7 Simple Ways To Minimize The Pennsylvania Inheritance Tax

What Is Estate Tax And Inheritance Tax In Canada

Where Not To Die In 2022 The Greediest Death Tax States

Estate Tax Exemption 2021 Amount Goes Up Union Bank

What Is The Stepped Up Basis And Why Does The Biden Administration Want To Eliminate It

Gifting Property To Children In 2022

Irs Announces 11 7 Million Exclusion For 2021 Estate Tax Capital Gains Tax Money Market

/estate_taxes_who_pays_what_and_how_much-5bfc342146e0fb00265d85b5.jpg)

Estate Taxes Who Pays And How Much

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

Https Www Forbes Com Sites Peterjreilly 2021 09 25 Time To Change Your Estate Planagain Estate Planning Estate Tax Grantor Trust

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

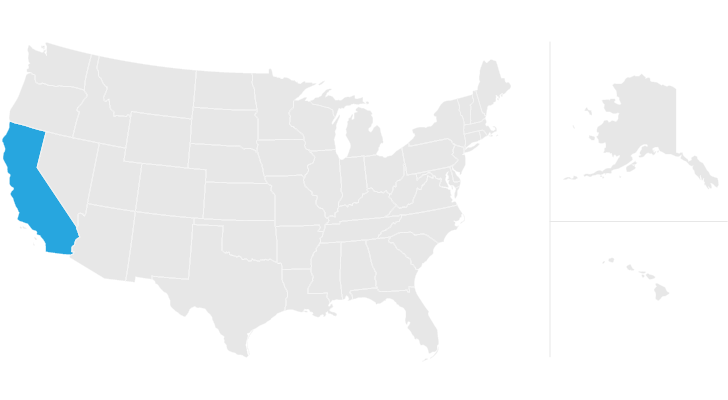

California Estate Tax Everything You Need To Know Smartasset

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning

California Estate Tax Everything You Need To Know Smartasset